Risk Matters

Advisers need to know their portfolio and diversify. The goal is to match portfolio risk with client risk levels. Knowing your equity risk is key to the equation.

“Love the comparative nature of it. It is nice and easy to use.”

Head of Manager Selection and Due Diligence, Large Trust Company, Boston

Advisers need to know their portfolio and diversify. The goal is to match portfolio risk with client risk levels. Knowing your equity risk is key to the equation.

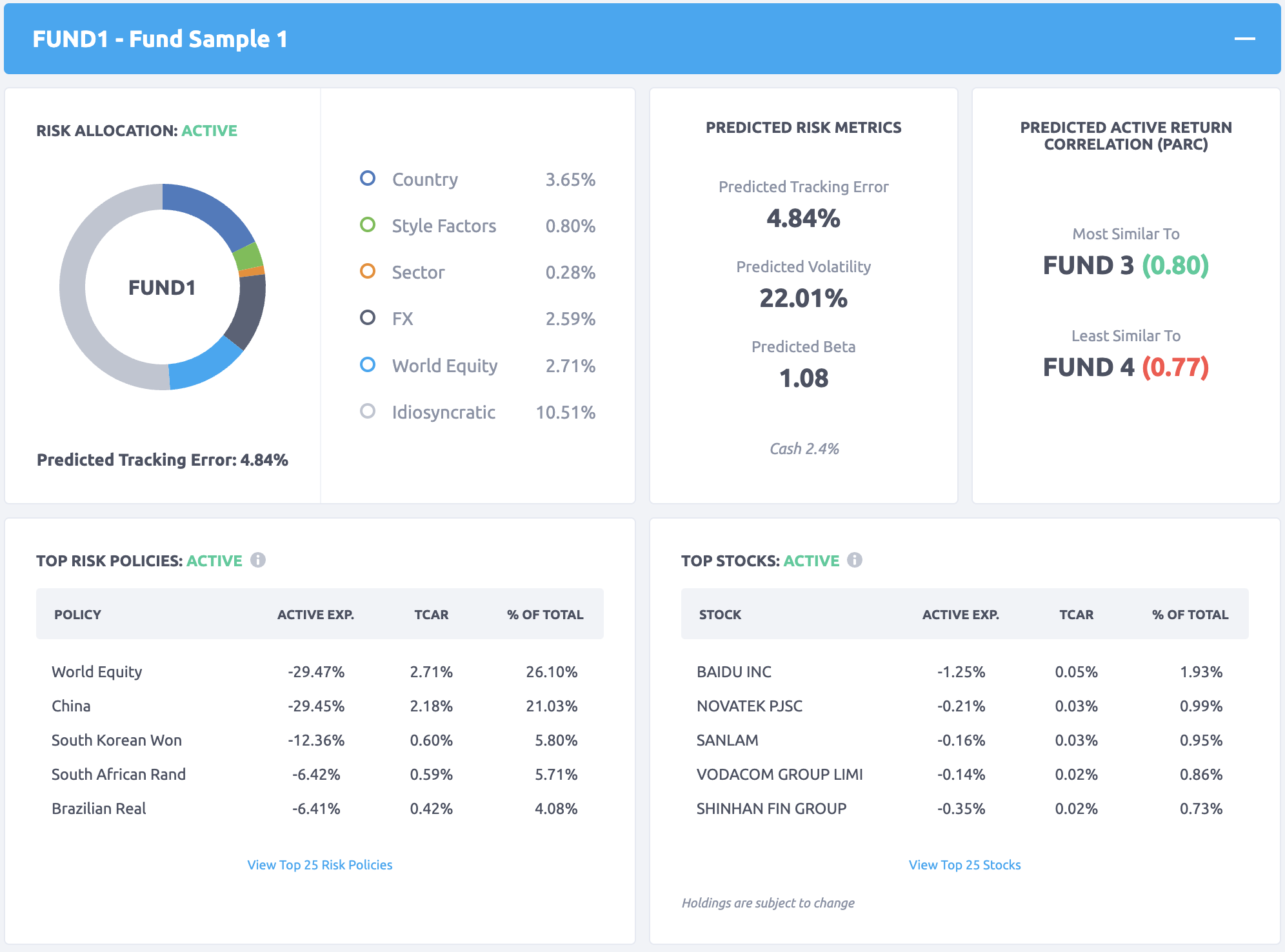

For equity portfolios, you need to see key risks. You need to know if the future returns of your funds and ETFs are predicted to be correlated or not. For some clients, you need ESG scores. And you want a powerful fund screener. That's why you need Risk Lens.

Risk Lens is an analytics tool that provides key equity portfolio risks, predicted active return correlations (PARCs), ESG scores, and fund screening.

For illustrative purposes only.

For illustrative purposes only.

Use Risk Lens to know your equity portfolio and diversify. Align portfolio risk with client risk levels. It's cloud-based and easy to use. And it's zero cost.

“Risk Lens is a useful tool for quickly evaluating a fund’s historical exposures and management style. The style factor exposures are very helpful, as are the active correlation statistics, as a starting point in determining complementary funds.”

Partner-Investment Management, Investment Management Firm, Seattle

Our risk model forecasts critical equity portfolio risk measures. Risk Lens is an extension of our model. In 2013, we developed the calculation of predicted active return correlation or PARC, which shows complementary and substitute funds. PARC forecasts correlation between two funds to avoid overlap and help ensure diversification. It also shows if substitute funds – used to replace funds for tax loss harvesting, high fees, etc. – are predicted to be highly correlated.

We crunch funds’ historical returns to their style, country, sector and currency exposures to forecast correlations from –1 to +1, ranging from exact opposite correlation to no correlation to exact correlation.

“We use it for underlying portfolio exposures and manager comparisons. We have primarily used it to identify complementary managers from a style standpoint.”

Anonymous

We know that our risk model and PARC formula for predicted active return correlation can help advisers build portfolios. Risk Lens looks forward – many other tools don’t. They focus on historical not forecast risk measures. They don’t show predicted active return correlations for funds. Or they’re too expensive.

We look at current fund holdings to calculate forecast risk measures and help predict fund return correlations. Most other tools are returns-based and tell you a fund’s past risk exposure. We forecast a fund’s future risk. You would have to pay thousands of dollars to get this holdings-based analysis from other institutional tools. With Risk Lens, you get it for zero cost.

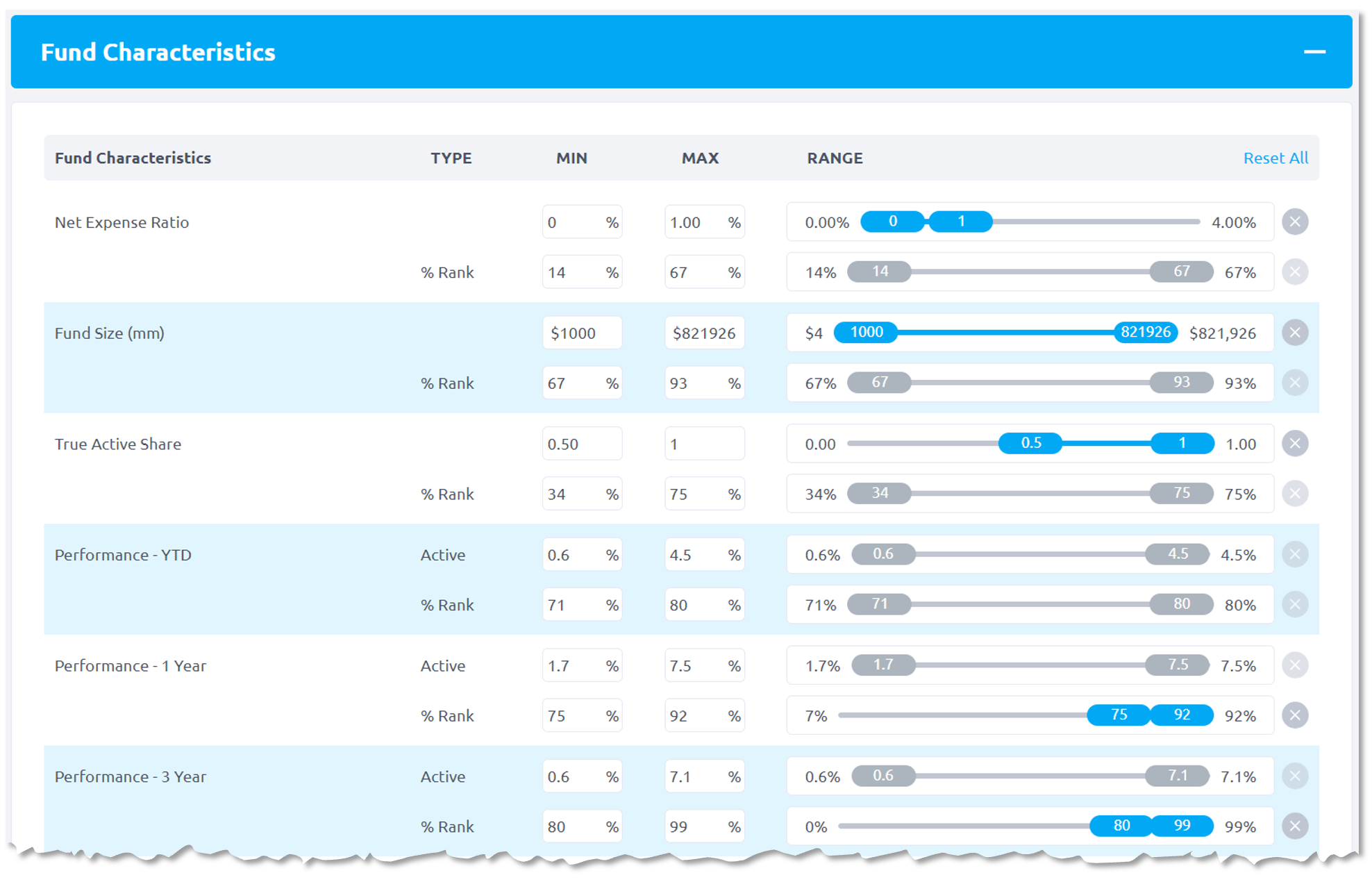

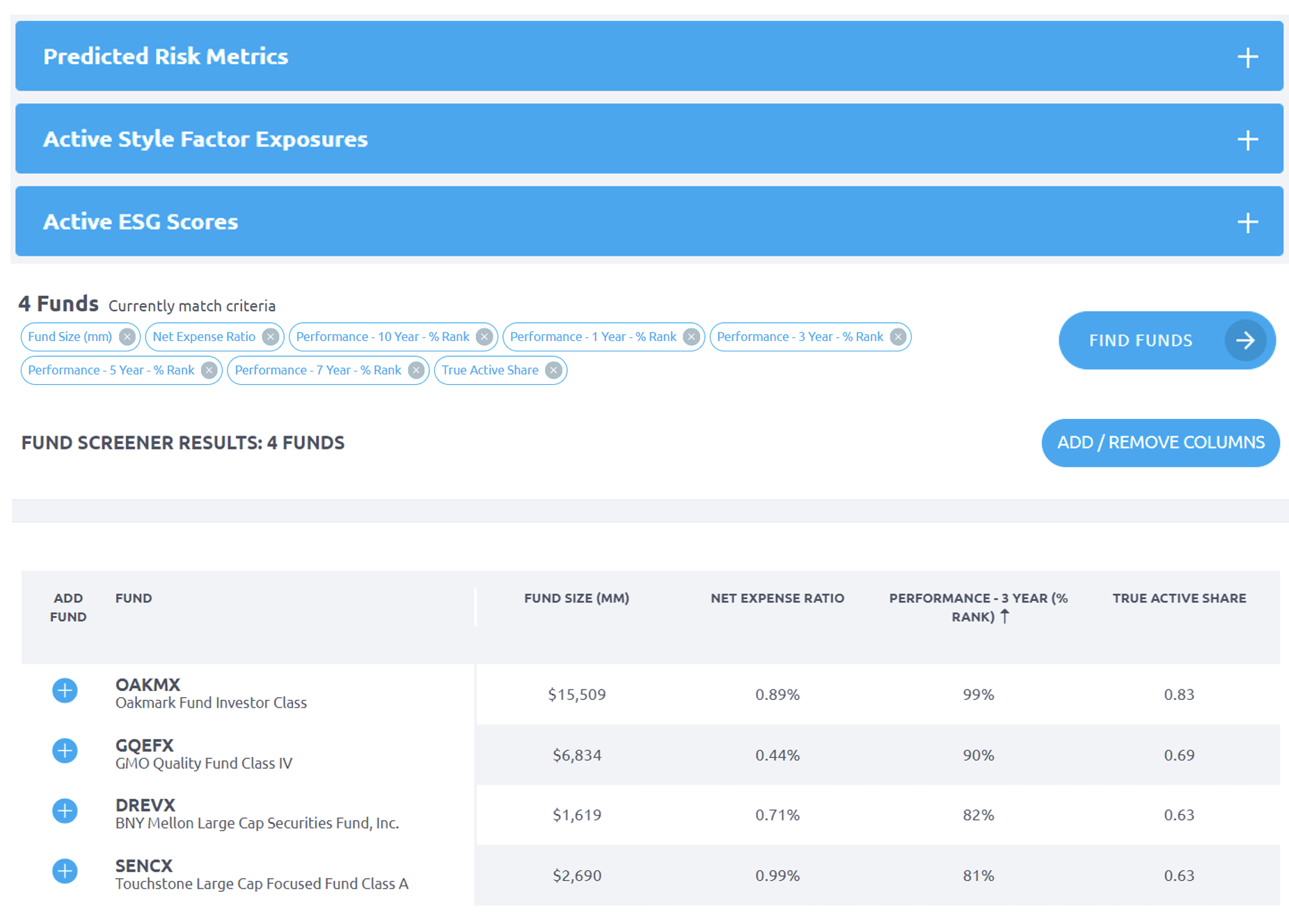

Find the funds you need – with ease

Pick a benchmark. Select screens for size, fees, performance, risk, and more. Then click “Find Funds.”

For illustrative purposes only.

For illustrative purposes only.

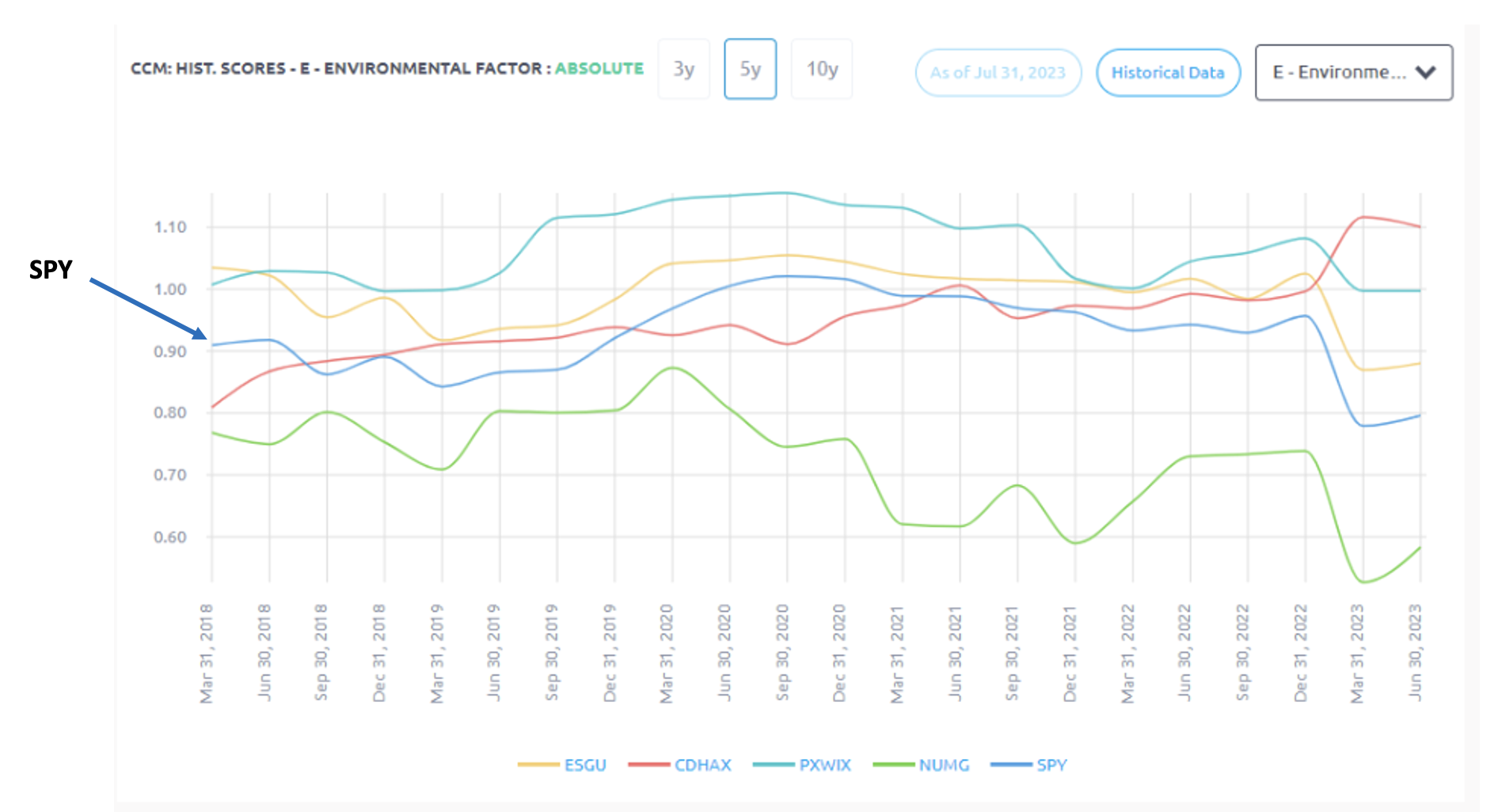

For your clients who want ESG-managed portfolios and investment performance, you can log into Risk Lens to access Causeway Fiduciary ESG Scores. We assess a company on environmental, social and governance (E, S and G) factors we believe are financially material for the company, considering its country and sector. Our research shows that firms with top quintile Causeway Fiduciary ESG Scores outperformed firms with bottom quintile scores and the global market over time. We call our scores “fiduciary” because they focus on material ESG characteristics and their potential to affect investment performance.

Causeway’s quantitative model assesses a company’s performance on financially material ESG factors considering its country and company characteristics. To calculate an overall ESG score, we assign E, S and G weights for a company. Currently, G is the highest weight and stays the same across sectors because we believe G applies equally to all companies. E is the next highest weight followed by S, and these weights are assigned based on their materiality in the company’s sector. A company’s overall score is the weighted average of its E, S and G scores, and we aggregate the scores of companies in a fund to calculate the fund’s overall ESG scores. To perform all these calculations, the model uses a wide variety of data from government and non-government sources.

The chart below compares SPY – an S&P 500 Index ETF – to certain ESG funds. Measured on Causeway's "E" score, not all of them have higher "E" scores than SPY over time.

For illustrative purposes only. Funds selected by Causeway from https://greenly.earth/en-us/blog/ecology-news/5-best-esg-funds-for-responsible-investors-in-2023 (accessed 6/20/23) + SPY. Greenley provides CO2 emissions measurement and other ESG services.

For illustrative purposes only. Funds selected by Causeway from https://greenly.earth/en-us/blog/ecology-news/5-best-esg-funds-for-responsible-investors-in-2023 (accessed 6/20/23) + SPY. Greenley provides CO2 emissions measurement and other ESG services.

We back-tested companies in the MSCI ACWI Index. Companies with top quintile Causeway Fiduciary ESG Scores from 2013 through 2022 outperformed companies with bottom quintile scores and the index. Back-tested information is for illustrative purposes only and should not be relied on as research or investment advice regarding any investment. See Disclosures for our back-test methodology and more information. For more of Causeway’s sustainable investing insights including videos, articles and webinars, visit this link.

In the MSCI ACWI Index, each month, we sorted stocks into quintiles by their Causeway Fiduciary ESG Scores from 2013 (inception of relevant underlying E and S data) through 2022. We calculated the one-month forward capitalization-weighted USD return of each hypothetical quintile portfolio to obtain a return time series for each portfolio. We z-scored the ESG scores by sector to make them "sector neutral." Returns are gross of fees and transaction costs. Source: Causeway Research.

These views are subject to change, and there is no guarantee that any forecasts made will come to pass. Forecasts are subject to numerous assumptions, risks and uncertainties, which change over time, and Causeway undertakes no duty to update any such forecasts. Information and data presented has been developed internally and/or obtained from sources believed to be reliable; however, Causeway does not guarantee the accuracy, adequacy or completeness of such information.

The returns are derived from back-tested data using a simulated investment process and do not depict actual accounts. There are numerous inherent limitations in the use of simulated information, including that it may not reflect the impact that material economic and market factors might have had on the portfolio managers’ decision making if they were actually managing accounts using that process. The simulated returns do not reflect contemporaneous trading or any transaction costs. Simulated returns may not be indicative of the future returns of any portfolio.

“It’s just interesting . . . another way to view things.”

Vice President-Financial Advisor, Global Brokerage Firm, Washington, DC

Risk Lens looks forward – many other tools don’t. They focus on historical not forecast risk measures. They don’t show predicted fund correlations. Or they’re too expensive.

Causeway manages global stocks, fusing fundamental and quantitative analysis since 2001. In 2013, we launched Risk Lens to bring the power of our risk analytics to clients, introducing the easy-to-use web application in 2019.

Risk Lens covers approximately 3,700 U.S.-registered equity mutual funds and ETFs, approximately 9,500 share classes, and 37 benchmarks across all major geographies.

“It’s a fun tool.”

Managing Director, Manager Research Team, Investment Management Firm, New York

Yes, but when you use our cloud-based tool, you select your own funds for analysis. You can include Causeway Funds, or leave them out.

We provide Risk Lens at zero cost. We think it’s a critical tool for our clients and advisers who use Causeway Funds. Why do we give it away? Because we believe investors make better decisions with better information. We think Causeway Funds compare well using Risk Lens forward-looking analysis.

Risk Lens provides key equity portfolio risks, predicted active return correlations (PARCs), ESG scores, and fund screening.

Use Risk Lens to know your equity portfolio and diversify. Align portfolio risk with client risk levels. It’s cloud-based and easy to use. And it’s zero cost.

“Provides a clean and simple way to review funds from a factor-based perspective in a robust manner.”

Investment Product Analyst, Large Bank, Kansas City

We value feedback from users. Use Risk Lens and send your comments to [email protected] or call us at 310-231-6100. If you are not yet a Risk Lens user, request a login below. We are happy to provide introductory training.

11111 Santa Monica Blvd.

15th Floor

Los Angeles, CA 90025

[email protected]

Inquiries: